How to Crack Bank Exam in First Attempt: Tips & Strategies

How to Crack Bank Exam in First Attempt:- Bank exams for positions like Bank PO, Bank SO, and Bank Clerk are competitive, but it is entirely possible to clear them in your first attempt. Many successful candidates have achieved this feat with the right approach. So, how can you crack the bank exam on your first try?

The key to success lies in diligent preparation and a focused strategy. Start by thoroughly understanding the syllabus and exam pattern. Once you're familiar with what to expect, take regular mock tests and practice solving previous years’ question papers. With consistent effort and a well-planned study routine, you can easily make it through the exam on your first attempt.

Check out: Banking Exam Preparation Books

Is It Easy to Crack Bank Exams in the First Attempt?

Cracking bank exams, such as how to crack SBI PO in the first attempt or how to crack SBI Clerk in the first attempt, is not as difficult as it may seem. With a comprehensive and well-structured banking preparation strategy, you can definitely outperform the competition. Many candidates have successfully cracked the bank exams on their first attempt, proving that with the right guidance and determination, success is achievable. To answer the question, “How to start preparing for bank exams?” it’s important to break down your approach and follow it consistently for the good results.

Bank Exam 2025

Looking to crack Bank Exams 2025 and secure good positions like SBI PO, SBI Clerk, or Bank SO? Success in these exams is possible with the right approach and strategy. Wondering how to crack bank exams or even how to do it in the first attempt? Start with a solid banking preparation plan.

Focus on understanding the syllabus and pattern, practising mock tests, and solving previous years' question papers. Whether you’re aiming to learn how to crack SBI PO in the first attempt or how to crack SBI Clerk in the first attempt, consistency and time management are key. Start preparing early, stay focused, and make the most of this opportunity. Here are some of the top profile of Bank Exam 2025.

1. SBI Specialist Officer (SBI SO)

The SBI SO exam is conducted to recruit specialised officers in fields such as IT, Law, Risk Management, and Marketing. These positions require specific ability, making this an excellent opportunity for candidates with professional qualifications. As a Specialist Officer, you’ll handle crucial banking functions requiring technical knowledge and skills.

2. SBI Clerk

SBI Clerks work as Junior Associates, handling customer interactions, document verification, and backend operations. This role is ideal for fresh graduates aspiring to start a career in banking. It offers a stable job with opportunities for growth within the largest public sector bank in India.

SBI Clerk Prelims & Mains Previous Year Solved Papers Book

3. SBI Probationary Officer (SBI PO)

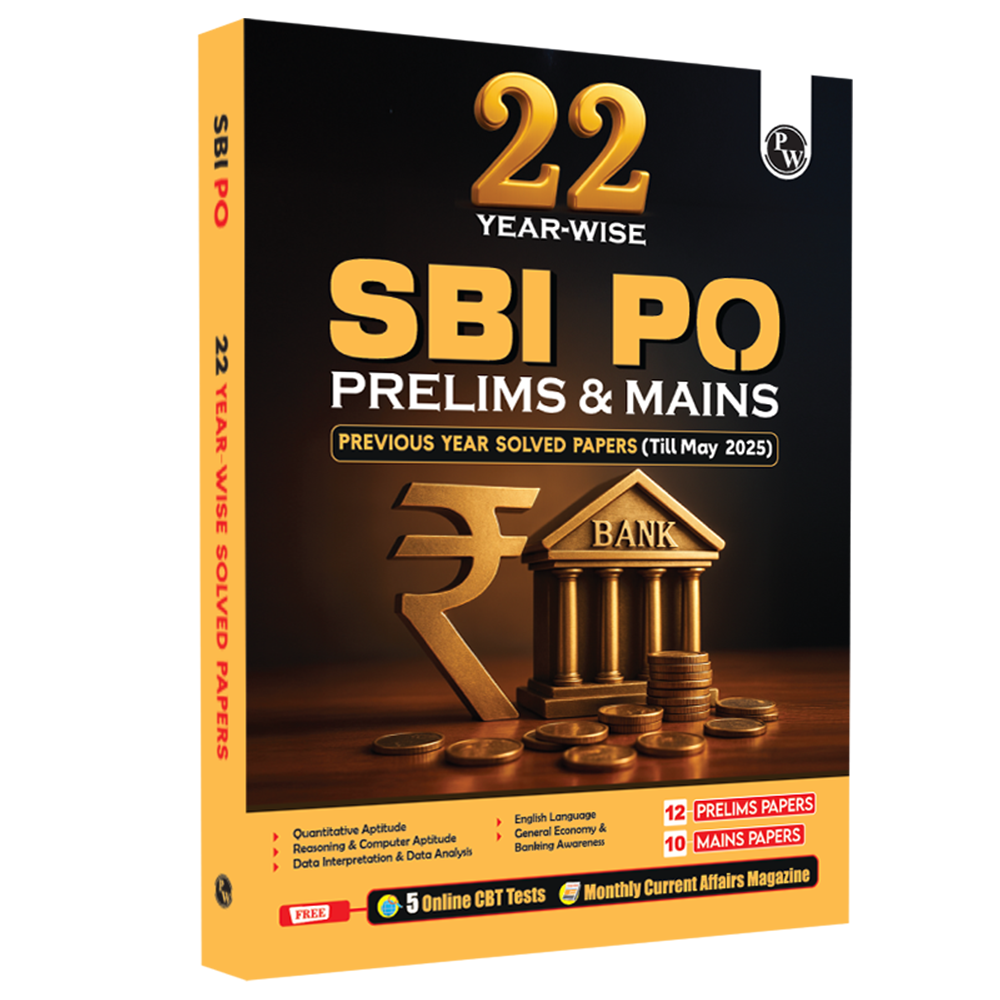

The SBI PO position is one of the most sought-after roles in the banking sector. As a Probationary Officer, you’ll undergo training in various departments, preparing you for a managerial role. The position offers dynamic growth opportunities and exposure to core banking operations.

SBI PO Prelims & Mains Previous Year Solved Papers Book

4. Central Bank Specialist Officer (Central Bank SO)

This recruitment drive is for specialised roles such as IT Officer, Risk Manager, and Security Officer. Central Bank SO positions are suitable for candidates with niche ability who want to contribute to the development of specific banking domains.

5. SIDBI Assistant Manager

The Small Industries Development Bank of India (SIDBI) recruits Assistant Managers to promote small-scale industries. This role involves analysing project proposals, sanctioning loans, and supporting small business enterprises. It’s an excellent opportunity for those looking to impact India’s MSME sector.

6. Karnataka Bank Clerk

Karnataka Bank Clerks manage day-to-day operations such as handling customer accounts, managing cash transactions, and resolving queries. The role is ideal for individuals looking for a customer-centric job in a reputed private sector bank.

7. IDBI Junior Assistant Manager

As a Junior Assistant Manager at IDBI, you’ll assist in branch management, operations, and customer relationship management. This entry-level role provides an opportunity to learn banking fundamentals and grow within the organisation.

8. MSC Bank Trainee Associate

Maharashtra State Cooperative (MSC) Bank recruits Trainee Associates to support various banking functions, from data entry to customer support. The position is designed for freshers aiming to gain hands-on experience in the cooperative banking sector.

9. SBI Apprentice

SBI Apprentice positions are apprenticeship roles where candidates undergo on-the-job training across various branches. This program helps candidates understand banking processes and prepares them for future roles in the sector.

10. IDBI Executive

IDBI Executives are primarily responsible for branch operations, including cash management, customer support, and account handling. This contractual position is ideal for graduates looking for short-term exposure to the banking industry.

Read More: Bank Exams 2024 Eligibility Criteria

How to Crack Bank Exam in First Attempt: Tips & Strategies

1. Understand the Exam Pattern and Syllabus

Bank exams generally consist of three stages:

-

Preliminary Exam: Objective test to screen candidates.

-

Mains Exam: Advanced test with objective and descriptive sections.

-

Interview: Final selection process to assess personality and knowledge.

Subjects Covered in Bank Exams

-

Reasoning Ability

-

Topics: Puzzles, Seating Arrangement, Syllogism, Blood Relations, Coding-Decoding, Inequalities, Data Sufficiency, Logical Reasoning.

-

Important Areas: Practice high-level puzzles and seating arrangements as these dominate the reasoning section.

-

Quantitative Aptitude (QA)

-

Topics: Simplification, Data Interpretation, Number Series, Quadratic Equations, Arithmetic Problems (Profit & Loss, Time & Work, Speed & Distance).

-

Important Areas: Data Interpretation and Arithmetic Problems like Percentage, Ratio, and Interest calculations are critical.

-

English Language

-

Topics: Reading Comprehension, Cloze Test, Error Spotting, Sentence Rearrangement, Fill in the Blanks, Vocabulary.

-

Important Areas: Focus on improving reading speed and accuracy, particularly in Reading Comprehension and Error Spotting.

-

General Awareness (GA)

-

Topics: Current Affairs, Banking Awareness, Static GK.

-

Important Areas: Stay updated on banking and financial sector developments, government schemes, and global events.

-

Computer Awareness (For certain exams)

-

Topics: Basic computer operations, MS Office, Internet and Networking Basics.

-

Important Areas: Learn basic terminology and concepts related to IT and banking software.

-

Descriptive Section (Mains)

-

Topics: Essay Writing, Letter Writing, Precis Writing.

-

Important Areas: Practice writing concise, well-structured essays and letters on current banking topics.

2. Step-by-Step Strategy to Crack Bank Exam

1. Build a Strong Foundation

-

Begin by understanding the syllabus and marking scheme.

-

Study NCERTs for Quantitative Aptitude basics and English grammar.

-

Master shortcut methods for solving questions quickly in Quant and Reasoning.

2. Create a Study Schedule

-

Allocate specific hours daily for each subject.

-

Dedicate 2-3 hours for Quant and Reasoning as they require practice.

-

Include time for revising GK and reading newspapers (The Hindu/Indian Express) daily.

-

Regularly practise mock tests and analyse your performance.

3. Focus on High-Scoring Sections

-

In the Prelims exam, Reasoning Ability and Quant are key scoring areas.

-

For the Mains exam, focus on General Awareness as it requires less time and can boost your score significantly.

4. Practice Mock Tests and Previous Year Papers

-

Take sectional tests to identify weak areas.

-

Solve at least 20–30 full-length mock tests before the exam.

-

Analyse previous year question papers to understand question trends.

5. Develop a Habit of Reading

-

Improve English comprehension by reading newspapers, magazines, and online articles.

-

Focus on editorials to enhance vocabulary and analytical skills.

6. Stay Updated with Current Affairs

-

Devote 30 minutes daily to reading current affairs.

-

Use monthly compilations for quick revision before the exam.

7. Time Management

-

Practise time-bound mock tests to simulate the exam environment.

-

Avoid spending too much time on one question during the exam.

8. Master Data Interpretation and Puzzles

-

DI and Puzzles are time-consuming but high-scoring topics.

-

Practise all types of DI (Table, Pie Chart, Bar Graph) and puzzles (Linear, Circular, Box).

9. Work on Speed and Accuracy

-

Develop a habit of solving questions accurately to reduce negative marking.

-

Use shortcut tricks for Quant and Reasoning to save time.

10. Revise Regularly

-

Create short notes for formulas, rules, and important facts.

-

Revise GK, Banking Awareness, and Computer Awareness every week.

3. Important Areas to Focus On

-

Prelims Exam

-

Quantitative Aptitude: Simplification, Number Series, DI.

-

Reasoning Ability: Puzzles, Seating Arrangement, Inequalities.

-

English: Reading Comprehension, Cloze Test.

-

Mains Exam

-

General Awareness: Current Affairs (past 6 months), RBI reports, and Banking terms.

-

Quant: Advanced DI, Probability, and Arithmetic.

-

Reasoning: High-level puzzles, Input-Output, Logical Reasoning.

-

Descriptive Section

-

Practice essays on topics like financial inclusion, digital banking, and economic reforms.

-

Learn formal and informal letter formats.

Check out: Bank PO and Clerk Exams Previous Year Solved Papers Book

Banking Preparation FAQs

1. Are mock tests important for preparation?

Yes, mock tests improve speed, accuracy, and familiarity with the exam pattern.

2. How can I improve speed and accuracy?

Practise with shortcuts for Quant and Reasoning and take timed mock tests regularly.

3. What is the descriptive section in bank exams?

It includes essay and letter writing to test your communication and writing skills.

4. Are previous year papers useful?

Yes, they help understand the exam pattern, important topics, and time management.

5. How should I manage time during preparation?

Create a timetable, focus on weak areas, and practise daily.